The UK – a good investment?

With tax increases totalling over £40bn and higher borrowing of £28bn per year, the Chancellor’s plan arguably reduces the UK’s competitive advantage for attracting investment. The UK tax burden now stands at its highest level since the 1940s, and closer to the average EU level. It is also rising relative to our G7 counterparts, meaning that the cost of doing business is increasing relative to these countries. The combined effect of taxation and borrowing increases may diminish perceptions of the UK as a good value investment.

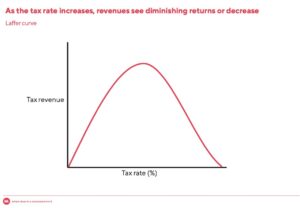

Shevaun Haviland, director-general of the British Chambers of Commerce described the budget as “a tough budget for business to swallow”. £25bn of the extra tax burden is to be taken on by businesses in the form of employer national insurance contributions (NICs), increasing to 15% from April, whilst the level at which employers start paying NI drops from £9,100 to £5,000. The UK will now be perceived as a more difficult place to do business, and with the increasing mobility of capital, we may see businesses leave the economy, taking their tax revenue with them (Figure 1).

Figure 1

UK-based investors feel the squeeze

UK-based investment products are less attractive as investors and Private Equity are also targeted by the new taxes in the form of higher capital gains tax (CGT) and higher rates on carried interest. The lower rates of CGT are increasing from 10% to 18%, and higher rates from 20% to 24%. The cost for realising any gains from investments is now higher, which may persuade investors to stay clear.

Other tax hikes indicate that belt-tightening will become reality for the full spectrum of UK investors. Higher stamp-duty on second homes, VAT on private school fees, taxes on air travel, increased burden on business owners, CGT, and changes to inheritance tax around pensions and farms all contribute to an all-round investor squeeze. This squeeze is felt around the means with which to invest and on the returns themselves. If investors are less willing and able to purchase financial products, value for money investing rises in salience in the decision.

Investing marketing money

Navigating this complicated environment is more about long term consequences than short term effects. How can marketers best communicate value to investors through products and services in an environment of change and uncertainty? Fundamentally the needs don’t change; an ageing population creates greater strain on public services and pension provision. This requires greater self-reliance in providing for individuals’ financial futures. We have been following this trend towards self-reliance in our annual report into the behaviours and attitudes of UK investors, The Investor Index. A burgeoning self-reliance was identified in 2023, which only grew in 2024. Limited solutions are presented by offering new and more complicated products. Building trust in a strong, reliable brand for the long term will be a key driver of growth. For investment marketers, Reeves’ simple ‘Invest, invest, invest’ mantra is perhaps no better applied than to brand.